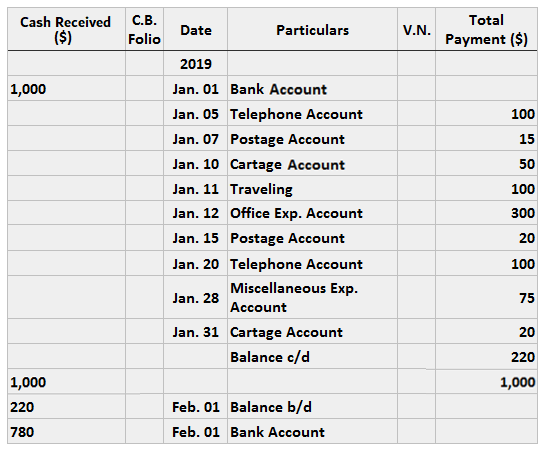

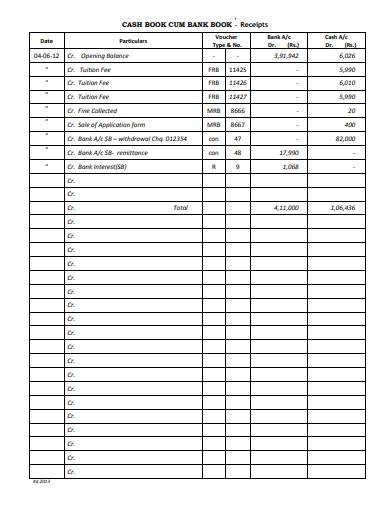

Check out our detailed guide on accrual vs. cash-basis accounting. Accrual accounting tends to be more accurate and gives a clearer picture of your long-term finances. That account is a liability on the balance sheet and contains all employee earnings. Payroll is a good example of an account that lends itself well to accrual accounting, as it has both an accruing and a cost component. For example, if a corporation uses the cash method to keep track of its finances, any bills over $1,700 one would record, once one makes the payment. On the other hand, if the corporation uses the accrual technique, the $1,700 will be deducted from its cash on the day it pays the payment.

Debits and credits increase or decrease the accounts in your books, depending on the account. Learn how to convert your books from cash-basis to accrual accounting. But first, consider the differences between the two accounting methods. To illustrate the change from an accrual to a cash basis adjustment, accountants employ specific formulas. The transition from accrual to cash accounting is simplified as a result. Journal entries made at the close of a reporting period to adjust the revenues or expenses shown on the income statement are accrual-type adjusting entries.

How Do You Explain Accrual to Non-Accountants?

Consequently, we had to debit cash of $30,000 and credit AR of $30,000. We subtract the sum of these cash receipts because they were earned in the prior period. If they haven’t been paid, they are considered current assets on the balance sheet. If they have been paid they are considered revenue on the income statement.

- Also, be aware that the use of the cash basis for tax reporting purposes is limited by the IRS to smaller organizations that do not report any inventory at the end of their fiscal years.

- That means borrowers could have three or four months’ worth of payments to deduct for 2023, which may reduce their tax liability.

- Speak to an accountant or tax professional to find out what applies to you.

- We need to subtract $30,000 from the $1.5 million as it applies to revenue from a prior period.

- Additionally, accrual-basis accounting offers a complete and accurate picture that cannot be manipulated.

- We are adding any transactions into accounts receivable because they will occur in a later period.

However, the cash basis method might overstate the health of a company that is cash-rich. That’s because it doesn’t record accounts payables that might exceed the cash on the books and the company’s current revenue stream. The accrual method records accounts receivables and payables and, as a result, can provide a more accurate picture of the profitability of a company, particularly in the long term. Cash-basis accounting keeps financial credits based on money flow. Specifically, it focuses on when money is received, or expenses get paid, which may not occur exactly when these items are accrued.

Difference between cash basis and accrual

This adds purchases which have not been paid for at the end of the accounting period. In addition to accruals adding another layer of accounting information to existing information, they change the way accountants do their recording. In fact, accruals help in demystifying accounting ambiguity relating to revenues and liabilities. accrual to cash As a result, businesses can often better anticipate revenues while tracking future liabilities. If companies incurred expenses (i.e., received goods/services) but didn’t pay for them with cash yet, then the expenses need to be accrued. Accrual accounting provides a more accurate picture of a company’s financial position.

Companies worldwide typically employ an Accrual Basis due to the matching notion. Accurately estimate the profitability over time by comparing the revenues and costs of a specific period. Accruals assist accountants in identifying and monitoring potential cash flow or profitability problems and in determining and delivering an adequate remedy for such problems. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

When Does a Company Account for Revenue If It Uses Cash Basis Accounting?

Get this delivered to your inbox, and more info about our products and services. The deduction’s $2,500 cap hasn’t been raised since 2001, despite the fact that student borrowers’ balances have ballooned. Depending on your tax bracket and how much interest you paid, the deduction could be worth up to $550 a year, Kantrowitz said. Before the Covid pandemic, nearly 13 million taxpayers took advantage of the tax break. The student loan interest deduction allows qualifying borrowers to deduct up to $2,500 a year in interest paid on eligible private or federal education debt.

- This is done by adjusting entries in the current and prior periods.

- Cash-basis accounting keeps financial credits based on money flow.

- This account shows your responsibilities for the immediate future.

- As a result, all of the previously recorded income and expenditures must be updated to reflect those already settled in cash.

- When you started your business, you might have chosen to use cash-basis accounting.