If money is received on Monday, but not recorded until Wednesday, the cash book will be inaccurate. The purpose of a single-column cash book is to provide a quick and easy way to track all cash receipts and payments made by a business during a given period of time. It is also useful in determining the net amount of cash on hand at the end of the period. To prepare a single-column cashbook, simply record all cash receipts and payments made by the business in a single column, with the net amount of cash on hand represented as a balancing figure.

Income Statement

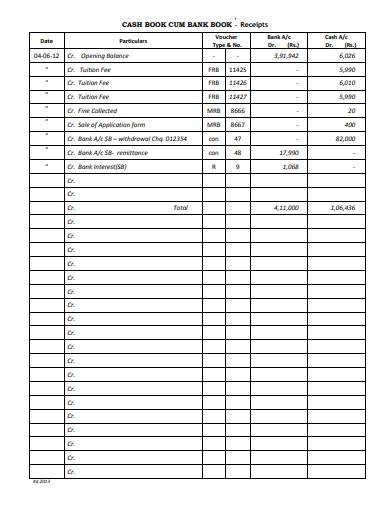

This data is then utilised for the preparation of the company’s financial statements. The amount of the check is recorded in the bank column on the debit side and the cash column on the credit side. The bank cash book is a type of cash book that is used to track the transactions between a business and its bank.

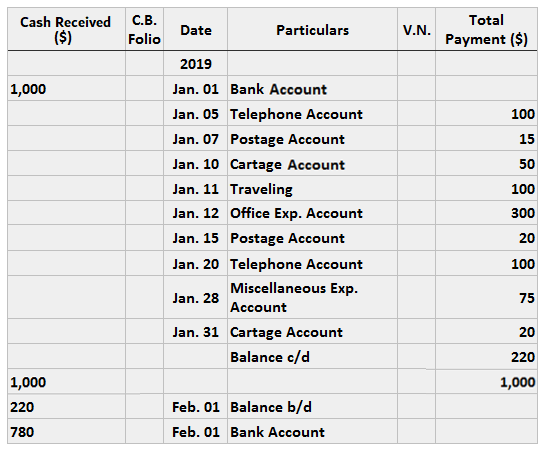

Single Column Cash Book

- Column WidthsThe Details column is 9cm wide.The other columns are 2.5cm wide – the cash book format looks more balanced if they are the same size.

- This form of a cash book has only one amount column on each of the debit and credit sides of the cash book.

- This type of cash book is used by businesses who want to track each individual transaction in more detail.

- For all purposes, a cash book is treated as a cash account (i.e., a part of the ledger).

In this article, we take two types of examples of cash books – Single Column and Double Column. The single-column cash book (also known as simple cash book) is a cash book that is used to record only cash transactions of a business. It is very identical to a traditional cash account in which all cash receipts are recorded on the left-hand (debit) side and all cash payments are recorded on the right-hand (credit) side in a chronological order. Cash books are used to track the transactions between a business and its bank.

What is a bank statement?

Passbooks will track all of the payments and receipts that have been made to and from the account. This includes a payment of cash made by the customer and payments made by the bank. The source of cash book entries are deposits received from banks, cheques issued to creditors.

This type is commonly used by individuals who want to keep track of their own money and finances. To use the single-column version of the cash book, transactions are noted in one column. The other side of the three column cash ledger would be headed ‘Credit’ and show an identical format with the three columns representing the monetary amounts of the cash payment, bank payment, and discounts received. The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book.

By reading this post, you may quickly prepare for accounting courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on. From the following information, prepare a Simple Petty Cash Book for the month of October, 2022. You can use one page a month, or if the entries are very few for each month, you can do two or three months on one page. You could just buy a school exercise book which already has rows printed in it, so all you have to do is draw in the columns.

This approach is particularly useful for mature companies with reliable net income but limited growth prospects. Banks and financial institutions are often challenging to value using traditional cash flow models due to complex capital structures and regulatory requirements. Instead, residual income valuation can be effective because it focuses on accounting-based metrics like book value and net income. By subtracting the required return on equity from net income, analysts can estimate the bank’s economic profit and gain a better understanding of whether it’s generating value over its capital cost.

P&G LLC records its cash and bank transactions in a triple-column cash book. The following transactions were performed by the company during the month of June 2018. A cash book is an important tool for businesses to help track their finances. They allow businesses to keep track of payments and receipts in a detailed way. This can be used to make important decisions about the future of the business. Additionally, cash books can be used to create financial statements.

All of this information is very important for accounting and tax records. It is essential for businesses to keep track of their finances 2020 form 1040 tax table in order to stay compliant with the law. A passbook, on the other hand, is typically kept by the bank and provided to the customer.

One column is for the transactions related to the cash, and the other column is for the transactions related to the business’s bank account. So, under the double-column cash book, the business also records cash transactions and transactions through the bank. But on the other hand, the transactions on credit are not recorded while preparing the double column cash–book.

The balance at the end of the day is put into the ledger as a cash account. A double column cash book, also known as a two column cash book, consists of two columns on each side to record cash and bank transactions. The main differences between a cash book and a pass book are how they track payments in cash and receipts, and who tracks them. A cash book format will track all of the money that is deposited and withdrawn from the account. The balance of cash in a cash book is the total amount of money that is currently in the account. This includes both the money that has been deposited and the money that has been withdrawn.